Archive

Scarcity Blog (Part Two) Published

I have just published the longer and I hope more interesting installment of my two-part blog on behavioral economics and in particular, on the implications of the arguments made in the book Scarcity for microfinance and more broadly for international development. It includes a brief analysis of Fonkoze’s CLM (“Pathway to a Better Life”) program through the behavioral economics lens.

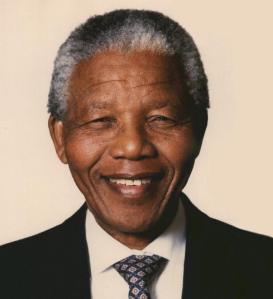

Nelson Mandela, and Father Joseph

As I read all the tributes to Nelson Mandela in the wake of his death yesterday at age 95, I recalled the fact that I memorably met the man once. It was at a small and magical dinner hosted by the philanthropists Craig and Susan McCaw in their Seattle home in the late 1990s.

In fact, I was one of two non-profit leaders asked to speak at this event attended by two dozen leaders from the worlds of business, philanthropy and government. A bit nervous as one can imagine, I gave a short talk on my work with Grameen Foundation. (Among those I met that night were the sitting Governor of the state of Washington and Bill Gates, but Mandela’s presence was what made the night so unique and thrilling.)

After each course was served and cleared, people were asked to move from one table to the next. This way, everyone got some time with Mandela and his wife, Graca Machel. By that time, Mandela was rather hard of hearing so it was not easy to engage him in conversation. But just sitting with him at a table for eight people for twenty minutes was quite something.

I see a lot in common between Mandela and Father Joseph Philippe, the founder of Fonkoze. Both are/were great moral leaders and men of action. Both are savvy (and occasionally infuriating) negotiators, practical visionaries, sometimes rather stubborn, and impossibly generous of spirit. Both emerged from their years in the wilderness – Mandela’s spent in prison, Father Joseph’s biding his time until the Duvalier dictatorship fell – and immediately started building movements to create social and political change. Clearly they are also different in many ways.

One of the stories that I hope gets told about both as people reflect on their lives is that of the friends, helpers, and “intrapreneurs” around Mandela and Father Joseph who were essential in allowing them to realize so many of their visions, even if not always in the exact forms they initially imagined.

Fonkoze on World Toilet Day

In the circles I move in these days related to my work with Grameen Foundation and Fonkoze, one often hears that more people in the world own and/or have access to a cell phone than to a toilet. I am not sure of the significance. Perhaps this factoid is meant to draw attention to the proliferation of mobile phones, or to the stalled effort to ensure safe sanitation, or maybe to misplaced priorities. (And if it is the latter, is it commenting on the priorities of the poor, or of development planners?)

Anyway, yesterday was World Toilet Day, something that Anne Hastings of Fonkoze brought to my attention when we were exchanging emails on another topic. Later, I read an op-ed in the New York Times criticizing the Gates Foundation’s emphasis on solving the world sanitation crisis through inventing new toilets for future deployment around the world. The thesis was that there are many low-tech and affordable solutions that already exist and the focus should be on them.

I have some sympathy for this view. A simplistic over-emphasis on “gadgetry” has infected many humanitarian efforts lately. At the same time, I think it is dangerous to dismiss the potential of new thinking, and new thinkers, to come up with technologies to better serve the world’s poor and organizations that work directly with them.

A critical factor with deploying solutions to the poor – whether they be low-tech or high tech, digital or analog, 20th century or 21st – is the institutional capacity of grassroots organizations to explain new ideas and technologies to the poor and provide the financing and troubleshooting needed to optimize impact. This is why organizations like Fonkoze are so essential, especially in places like rural Haiti where there is such a paucity of strong private, public and humanitarian institutions. (I made some similar points about the challenges confronting the “financial inclusion” agenda in a recent blog.)

In any case, as I compose this I am en route to Haiti for a meeting of the Fonkoze Family Coordinating Committee (that I described in another recent blog) and for a celebration of Anne Hastings 17 years of service in Haiti. I will be reporting on all this in the days ahead. As part of this celebration, I have been re-reading and re-posting my four-part series on Anne that was published last year.

A Surprising Microfinance Researcher and Possible Implications for Haiti

After not posting anything on this blog for more than eleven months, I hope at least a few people are still paying attention. If so, they could reasonably ask me about the status of my book on Fonkoze, and of Fonkoze itself. I will largely leave the answers to those questions to future posts. My book is on the backburner for now, though I hope to pick it up and complete it in a couple of years. By that point, I may have more time to write and the Fonkoze story will be less in flux. I will soon be posting a blog about some major developments with Fonkoze and the role I have been playing.

One of the things that has preoccupied me over the last couple of years has been the mostly tumultuous relationship between the microfinance movement on the one hand, and a new generation of researchers that has been studying it on the other. I recall a colleague saying to me in the late 1990s that a new generation of PhDs would warm to the task of trying to debunk the myth of microfinance being an effective tool to fight poverty. To some extent, that confrontation has come to pass.

Certainly, microfinance practitioners and advocates have contributed to this conflict by their (I suppose I should say our) collective lack of curiosity and defensiveness about research findings showing our weaknesses, and also by not being as welcoming as we could be to researchers wanting to study our flagship organizations (which has helped lead them to focus mostly on second and third-rate microfinance institutions). Needless to say, there have been noteworthy exceptions, such as Chris Dunford, formerly the CEO of Freedom From Hunger, and Beth Rhyne, the director of the Center for Financial Inclusion at Accion who recently joined the Grameen Foundation Board of Directors.

Still, researchers are far from blameless. When the media has covered their studies, they have tended toward oversimplified and sensationalistic headlines and stories – which the researchers, perhaps pleased that they were getting any mainstream coverage at all, have done too little to respond to and correct. Furthermore, while the most serious researchers (such as David Roodman) have come to the conclusion that reliable financial serves are extremely valuable to the poor – in fact, more valuable than they are for the non-poor – they have been unwilling to question whether it might be issues with their research methods (rather than entirely with MFIs’ practices) that have caused little positive impact being measured from microfinance in recent studies (aside from contract savings programs), particularly since few dispute that well-run MFIs collectively provide reliable financial services to the poor on a massive scale. (If one casts a broader net in terms of what one considers valid research, as I do, there are quite a few encouraging findings.)

But most damning in my mind is the fact that researchers have failed to do much to help ensure that what they have uncovered about what works well in terms of microfinance program operations is digested by practitioners and turned into better services delivered to the poor. For example, Dean Karlan’s flawed but impressive book More Than Good Intentions, which I reviewed, is chock full of tantalizing nuggets about what researchers have learned about what works best in delivering microfinance services. Unfortunately, those insights usually get buried amongst other findings and rhetoric, and are generally not understood by practitioners.

As a result, I have been trying to argue that we should hold researchers to the standard they hold the rest of us – they should measure whether their research, on which millions of dollars are spent every year, produces any positive change. More tangibly, I have been urging the research community for months to write up in a single paper the “lessons for practice” coming out of their many studies of microfinance, so that we get beyond debates about “whether microfinance works” to more fruitful and action-oriented dialogues about “how it can work better.” My advocacy has been met with deafening silence … until a surprisingly satisfying and productive encounter with a researcher this past summer.

By way of background, I first met Tim Ogden, the managing director of the Financial Access Initiative at NYU, at a social enterprise conference organized by the Stern Business School in November 2012. He was generally rather contrarian and pugnacious, but he made some good points. At the end of his session he went out his way to compliment my colleague Matthew Speh, who was also on the panel, for his emphasis on grounding strategy in research on customer needs and behaviors. Maybe there was more to Tim than met the eye.

Fast forward a few months, and Tim was spending a couple of hours with the Microfinance CEO Working Group (MCWG) that I am a founding member of. The MCWG has been grappling with how to better quantify our collective outcomes and impacts on poverty, and Tim was giving us some sensible and constructive feedback. At one point, I raised the issue of whether he or some researcher he might identify could come up with the “lessons for practice” paper I had been advocating (perhaps prompting some eye-rolling by my CEO colleagues who had heard me beat this drum before).

Tim immediately saw how this could be helpful and said he would take a serious look at taking it on himself. Some weeks later I called him to make sure he understood our request (since one CEO colleague had a different recollection), and he and I were on the same page and in fact, he had already made some real progress. Even if he does not produce this paper himself, I admire his can-do attitude and constructive approach.

Coming back to Fonkoze, Tim said something during his time with the MCWG that really struck me. He said that one of the hypotheses that merited testing was whether the hundreds if not thousands of well-run MFIs that provide reliable and reasonably efficient financial services, without requiring bribes, have helped raise the expectations of millions of poor people about the quality of services they deserved in general. If true, this could have profound impact on how the poor interface with their local and national governments as well as the private charities, faith-based institutions and businesses that serve them. More demanding and discriminating customers of these services could cause a chain reaction of improvement and investment, assuming public, charitable and commercial entities are responsive (and certainly some are, based on their desires for, if nothing else, reelection, profits, etc.).

He also raised some other interesting issues related to the indirect impact of microfinance on national development, such as MFIs collective success in training of hundreds of thousands of employees to provide reliable and often excellent customer service and to manage operations efficiently – skills that are often in short supply in developing countries and that are likely transferred to the broader economy as employees leave MFIs to work elsewhere.

The particular theory about raising the expectations of the poor, if proven to be true, may point to one of Fonkoze’s most profound and lasting impacts in rural Haiti – a place where the government, charities and businesses provide few services, and what they do provide is often haphazard and substandard. The process of Haiti developing into a self-sufficient democracy free from abject poverty is obviously going to take many years and a wide variety of complementary strategies. But I believe that progress is possible.

When I recall the Bangladesh I encountered when I first landed there in December 1988, it was not that much farther along than Haiti is today. By 2013 Bangladesh, despite its many problems, has already met its 2015 Millennium Development Goals concerning halving the number of people in extreme poverty and reducing child deaths, and is on course to meet almost all of the rest of those goals. Imbuing its population with higher expectations from the institutions that serve them will certainly be a part of Haiti following a similar course. How interesting it would be to have researchers test that hypothesis in the years ahead!

So let me tip my hat to one researcher whose constructiveness and fresh ideas have impressed me, and who has also given me a possible new reason to appreciate the important work of Fonkoze.

(A follow up post to this blog can be accessed here.)